Content

It’s important to make sure any ecommerce bookkeeping solution you choose, has the ecommerce knowledge you need to get the most from your financials. But, not everyone knows that the components of this calculation are different for ecommerce businesses. When you were daydreaming about building your ecommerce empire, tracking your income and expenses likely wasn’t part of the fantasy. If that’s the case, don’t worry — there are plenty of bookkeeping solutions to match your preferences. This financial information reveals insights into where you’re spending money and how your business makes revenue. Also, having detailed financial records makes tax season less of a headache.

Bookkeeping for eCommerce: What Things to Consider – ScandAsia.com

Bookkeeping for eCommerce: What Things to Consider.

Posted: Mon, 13 Feb 2023 08:01:07 GMT [source]

Especially compiling reports and manually working with the data. Made in the UK by ex e-commerce sellers and accountants.

How much will my eCommerce bookkeeping and accounting cost?

You can add additional users to your account with no limit to how many you can add. You’ll see add additional users how easy it is to add additional users to your account when using Link My Books. You will only need one user account, under which you can add all your clients. Our step-by-step guide will help you add a client account in no time.

- Make sure your bookkeeper or accountant understands the complexities of sales tax nexus and how to manage the compliance requirements.

- Your Bench bookkeeper works in-house, and they’re backed by our in-house research team to provide you with informed answers to complex questions.

- In this section, we’ll look at the most frequent challenges e-commerce business owners face with bookkeeping.

- Send clean summary invoices for each payout to Xero or QuickBooks in one click.

- It’s your choice whether to continue with them, work with one of our partner firms, or seek out a brand new tax expert in your area.

If https://www.bookstime.com/ing and managing your expenses and revenue sounds intimidating, you’re not alone. You have decided not to put all our eggs in one basket, so you are selling products on multiple channels. Acuity provides the external guidance to successfully implement the technology and processes to manage and grow your Ecommerce business. You don’t have to wait, we wait for your call to support the accounting business.

What is bookkeeping?

Packages include tax prep, filing, and consulting, too. Every service to save you money at tax time, with access to a CPA all year. We specialize in eCommerce accounting so you stress less, save money, and grow your business. Whether you are selling on one platform or multiple marketplaces, owning an eCommerce store is not always easy.

- A list of the essential ecommerce bookkeeping processes you should be implementing every week, month, quarter and year.

- Of course we can, if you’re hiring us to be your bookkeeper.

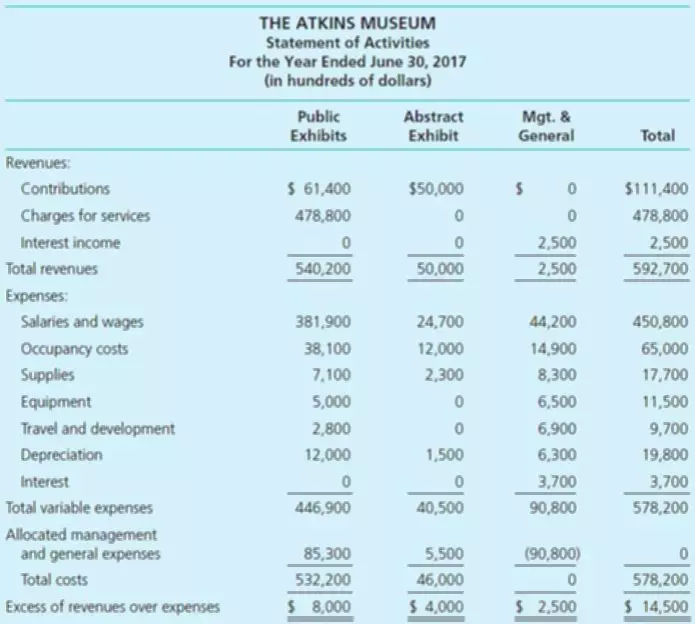

- This document contains all the money coming into the company over a specific period.

- If your accountant isn’t familiar with those laws, you may overpay your tax bill.

- From calculating taxes on online sales to inventory management to figuring out shipping logistics, running an online store comes with a whole host of challenges and considerations.

Here, we will delve into the four key areas that set ecommerce accounting apart from accounting for other businesses. Don’t underestimate the importance of setting up your books based on ecommerce best practices.