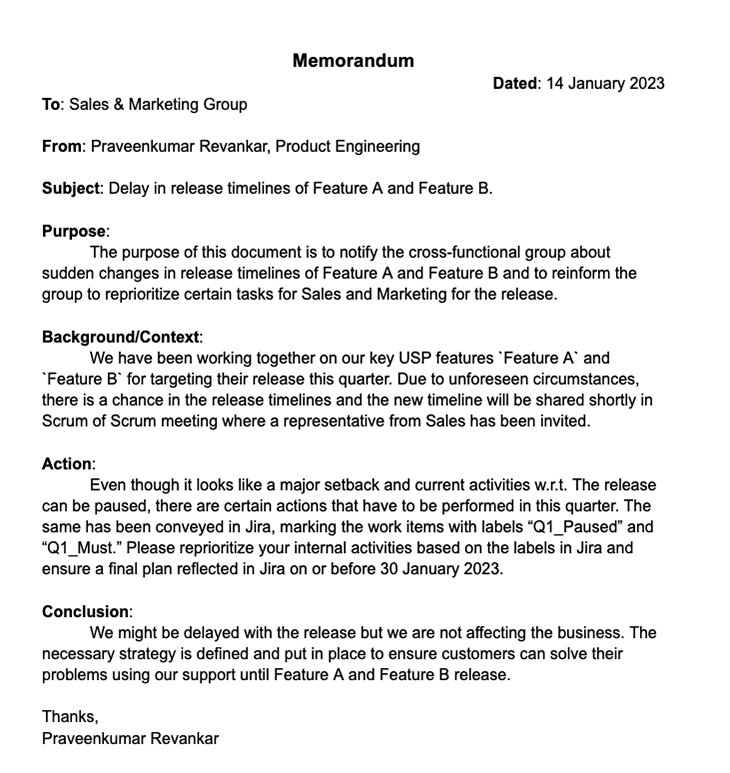

If you are a product manager and thinking “why does a product manager need to write a memo? ” I do and have been using memos to communicate for many years. An appreciation is an email or a letter, but it cannot be a memo.

Step 4 – Write Clearly and Concisely

A memo’s content, of course, is guided by the assignment and the research required. It is important to remember as you present the content that selectivity and relevance matter greatly. Your job is to select and present the most pertinent, most current information available to you. Do not hesitate, of course, to let your memo’s content be heavily informed by your research, but also provide your own interpretation and organization of this research. A memo is meant to inform a group of people about a complex topic, a policy change, or other brief official business within an organization. Always consider the audience and their needs when preparing a memo.

Selection and Citation of Content

On the other hand, an overall concept of reduced paragraph length is still applicable. A closing paragraph in writing a memo in its template is not a traditional conclusion. Basically, a concluding section of such a paper contains an invitation for a response or a call for action (Edmondson, 2019). This aspect depends on a content of a letter and a target audience.

When to Write a Memo

Clearly state the specific HR-related purpose or topic of the memo. This could be about a new policy, a reminder about existing policies, updates to HR procedures, or any other HR-related announcement. When writing a memo in APA format, there are a few things to remember. APA memo format is particular, and APA formatted memos have a specific appearance.

- APA in-text citation is done by providing the author’s last name and the date of publication in parentheses after the relevant piece of information from the source.

- But a good memo always gives a background and sets the context for the reader before publishing its story and action.

- You may use bullet points in this section to list out details, directions or facts.

Part 17Tips for Effective Memo Writing

This bit of internal communication will be read by my peers, my boss, and likely my boss’s boss. Getting the language right is essential, and every word counts. The overall format of a memo can be broken down into the heading, the body, and the closing notations. When an organization makes policy, procedural, or high-level staffing changes, an internal change memo should be written.

The body segment, sometimes called the discussion segment, of a memo is where the most important details that support your ideas are. You should begin this section with your key findings or recommendations for the reader. Your discussion section can also include any supporting ideas, facts or research that you have to share with the reader.

It is useful to begin by considering that a memo is essentially a one-on-one communication between writer and reader. When you write a memo to a professor in the classroom setting, you are much like the employee who has been assigned to investigate a problem and report back to a supervisor. Therefore, you are expected to provide concrete information, even information that the supervisor might already know, in a form that clarifies ideas and puts them into context. Primary segments of what is a memo and its template are discussed exhaustively. In particular, a memorandum is a structured document, but unique variations may occur depending on a specific content and institutional restrictions.

This memo format could be applied to other building updates, work-from-home days, or other widespread but minor announcements. There are logistical aspects of a business that concern your employees but don’t necessarily involve their work. This memo depicts an example of a kitchen remodel in the office. It’s a bit of an inconvenience but not one of a large magnitude. To make your memo easier to read, use headings and separate paragraphs to break up new thoughts or talking points.

It is essential to be clear and concise when writing an informative directive. Bullet points can break up longer paragraphs, making the information easier to digest. Furthermore, an informative memo should be formatted according to APA style guidelines. Memorandums or memos are an official means of communication used in many organizations. Basically, learning its structure and a content of each section is necessary for any individual to write an effective formal letter.

It may also be used to update a team on activities for a given project or to inform a specific group within a company of an event, action, or observance. To write an effective business letter, you must include seven basic parts in your document, which may include an enclosures line as needed. You write “Memo” or “Memorandum” at the top, followed by a To line, a From line, a Date line, a Subject line, and then the actual body of the message. For announcing a policy change within your organization, a policy change memo is necessary. Start by stating the purpose of the memo and clearly mention the policy being updated or replaced. Describe the reasoning behind the change and outline the new policy.

In this section, I note who the memo is to, who it’s from, the delivery date, and the subject of the memo. As in any essay, you must document the sources of your information so that your reader could find the original source of the information if desired. If your memo uses sources, provide the bibliographic information related to your sources on a References page as an attachment at the end of the memo—just as I have in this what are the four elements of a memo heading? memo. The Closing Notations The closing notations, used to identify such things as attachments, appear at the left margin two lines below the text of the final paragraph. The Body The body of the memo follows the Introduction, and it is usually presented in single-spaced paragraphs with a line skipped between each paragraph. The first lines of new paragraphs can appear at the left margin or they can be indented five spaces.