Contents:

A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. Analysts have forecast the company to bring in revenue of $381.39 million for the current quarter, with the likely lows of $379 million and highs of $388.3 million. The average estimate suggests sales will likely up by 12.50% this quarter compared to what was recorded in the comparable quarter last year.

- You will work in close collaboration with cross-functional R&D teams at multiple locations.

- The San Jose, California-based company, which has a market value of $1.6 billion, is working with investment bank Centerview Partners on a sale process that will launch in a few weeks, the source said.

- From the analysts’ viewpoint, the consensus estimate for the company’s annual revenue in 2023 is $1.7 billion.

BlueAlly is committed to building long term trust relationships by delivering outstanding network solutions, world class products and services, and round-the-clock support to their clients. Infinera Corporation, whose market valuation is $1.59 billion at the time of this writing, is expected to release its quarterly earnings report May 01, 2023 – May 05, 2023. Investors’ optimism about the company’s current quarter earnings report is understandable. Analysts have predicted the quarterly earnings per share to grow by -$0.02 per share this quarter, however they have predicted annual earnings per share of $0.23 for 2023 and $0.46 for 2024. It means analysts are expecting annual earnings per share growth of 91.70% this year and 100.00% next year.

Pyxis Oncology Inc. (NASDAQ: PYXS): A Great Stock To Watch

For the best MarketWatch.com experience, please update to a modern browser.

After this action, RIEDEL GEORGE ANDREW now owns 82,451 shares of Infinera Corporation, valued at $52,798 using the latest closing price. During the last 5 trading sessions, INFN fell by -7.11%, which changed the moving average for the period of 200-days by +33.02% in comparison to the 20-day moving average, which settled at $7.44. In addition, Infinera Corporation saw 4.60% in overturn over a single year, with a tendency to cut further gains. Rosenblatt, on the other hand, stated in their research note that they expect to see INFN reach a price target of $12.

Infinera Corp.

Over 2000 patents have been filed by Infinera in fields including optical transport and the virtualization of optical bandwidth. Volatility was left at 4.17%, however, over the last 30 days, the volatility rate increased by 3.57%, as shares surge +2.92% for the moving average over the last 20 days. Over the last 50 days, in opposition, the stock is trading -5.50% lower at present. We are looking for an experienced software QA engineer to join our team. As a QA engineer, you are required to have knowledge of SONET/SDH/OTN, Ethernet, ROADM optical technology, optical amplifiers, and modulation formats and a clear understanding of optical networks.

Our employee-led, executive-https://1investing.in/ed ALL-In initiative, along with employee resource groups like Women In Infinera , lead Infinera in our commitment to fully embracing diversity, inclusion, and equal opportunity in all aspects of our business. Working with cutting-edge technologies is challenging, providing opportunities to learn, grow, and enjoy. We have a complete view of the development cycle while aligning our personal career goals with company goals. Transparency, team work, and pursuit for excellence is the culture in Infinera, with approachable and helpful team members. Great rewards and recognition programs with a healthy work-life balance make it the best place to work. INFN gets a Bearish score from InvestorsObserver Stock Sentiment Indicator.

Juniper Networks Inc. shares are off more than 3% in premarket trading Monday after Citi Research analyst Jim Suva downgraded the stock to sell from neutral. Networking firm Infinera Corp.’s shares sank more than 10% in after-hours trading Tuesday after the company reported larger quarterly losses than expected amid the COVID-19 pandemic. HEARD DAVID W, the Chief Executive Officer of Infinera Corporation, purchase 6,500 shares at $5.72 during a trade that took place back on May 19, which means that HEARD DAVID W is holding 608,740 shares at $37,156 based on the most recent closing price. Reports are indicating that there were more than several insider trading activities at INFN starting from RIEDEL GEORGE ANDREW, who purchase 10,000 shares at the price of $5.28 back on Jun 10.

Infinera downgraded to underweight from neutral at J.P. Morgan

Customers include Tier 1 domestic carriers, Tier 1 international carriers, MSO/cable operators, Internet content providers, incumbent carriers, research/education/government, and wholesale bandwidth providers. Its specialists are interested in stocks that have been undervalued by different reasons. They are trying to find them, count their potential and bring them to their clients. This category considers companies that aim to position Mexico in exports, investment attraction, and business expansion globally, mainly in the telcos and ISP sector. At Infinera, we believe in embracing different perspectives and backgrounds to foster inclusion and belonging. We strive to bring all the unique pieces together to build a strong team with a shared vision that works toward common goals.

Utilizing our uniquely differentiated technology, we have created a Digital Optical Networking system with more speed, capacity and scalability than ever before. The network of tomorrow will allow for content and creativity limited only by the imaginations of its users. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. The startup remained in stealth mode until its first products were launched in 2004, although a few early media articles did describe the company’s component technology – a photonic integrated circuit in indium phosphide.

On the technical side, indicators suggest long term liabilities examples has a 50% Buy on average for the short term. According to the data of the stock’s medium term indicators, the stock is currently averaging as a 50% Buy, while an average of long term indicators suggests that the stock is currently 50% Buy. The average price predicted by analysts for INFN is $9.19, which is $2.14 above the current price. The public float for INFN is 216.81M and currently, short sellers hold a 18.60% ratio of that float. At Infinera India, we’re passionate about transforming the world for good by continually reimagining telecommunications networks to improve how people communicate and build a more sustainable future.

Infinera upgraded to buy from hold at Stifel Nicolaus

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers. Beyond Technology and Infinera collaborated to support a service provider’s increase of its network infrastructure during the 2022 FIFA World Cup in Qatar to support the increase in local traffic demand.

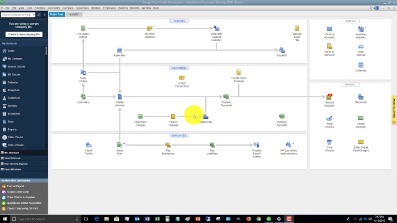

~3,200Website Corporation is a San Jose, California-based vertically integrated manufacturer of Wavelength division multiplexing -based packet optical transmission equipment and IP transport technologies for the telecommunications service provider market. It is a pioneer in designing and manufacturing of large-scale photonic integrated circuits . Our leading-edge solutions directly impact society by powering the innovations of today and tomorrow, from 5G and IoT to smart cities and beyond.

Here is the average analyst rating on the stock as represented by 1.00 to 5.00, with the extremes of 1.00 and 5.00 suggesting the stock should be considered as either strong buy or strong sell respectively. The number of analysts that have assigned INFN a recommendation rating is 9. Out of them, 3 rate it a Hold, while 4 recommend Buy, whereas 0 assign an Overweight rating. 0 analyst have tagged Infinera Corporation as Underweight, while 2 advise Sell. Analysts have rated the stock Hold, likely urging investors to take advantage of the opportunity to add to their holdings of the company’s shares. A company’s earnings reviews provide a brief indication of a stock’s direction in the short term, where in the case of Infinera Corporation No upward and no downward comments were posted in the last 7 days.

Pry Financials raises $4.2M to make startup accounting more approachable – Yahoo Finance

Pry Financials raises $4.2M to make startup accounting more approachable.

Posted: Mon, 23 Aug 2021 07:00:00 GMT [source]

CEPC selected Infinera’s XTM Series due to its compact, efficient, and flexible design enabling cost-effective scalability in a wide variety of network scenarios. Deployments leveraged a fully ROADM-powered DWDM optical layer and a combination of Layer 1 and Gb/s traffic management solutions. Infinera Corp is a global supplier of networking solutions comprised of networking equipment, software and services.

With 40+ years of experience and 1,550+ patents powering the most demanding networks in the world, we’re part of a pioneering team distinguished by its proven history of challenging conventional thinking. Redefining transport networks for a new generation of connectivity services. The company’s business strategy has been based upon introducing of leading edge speeds, initially with 10 Gb/second, and as of 2013, 100 Gb/second and 500 Gb/second based upon Superchannels .

How Jessica Mah Burned Through $1 Million in Funding and … – Inc.

How Jessica Mah Burned Through $1 Million in Funding and ….

Posted: Sun, 09 Apr 2017 03:25:28 GMT [source]

We are looking for experienced software development engineers to join our R&D team. As a software development engineer at Infinera, you will work in a cross-functional, agile team developing embedded software products. You will work in a Linux environment in close collaboration with the rest of the R&D organization. Infinera encourages my team to challenge the status quo in the engineering process, identify improvement areas, and continuously experiment with the aim of improving Infinera’s products and services.

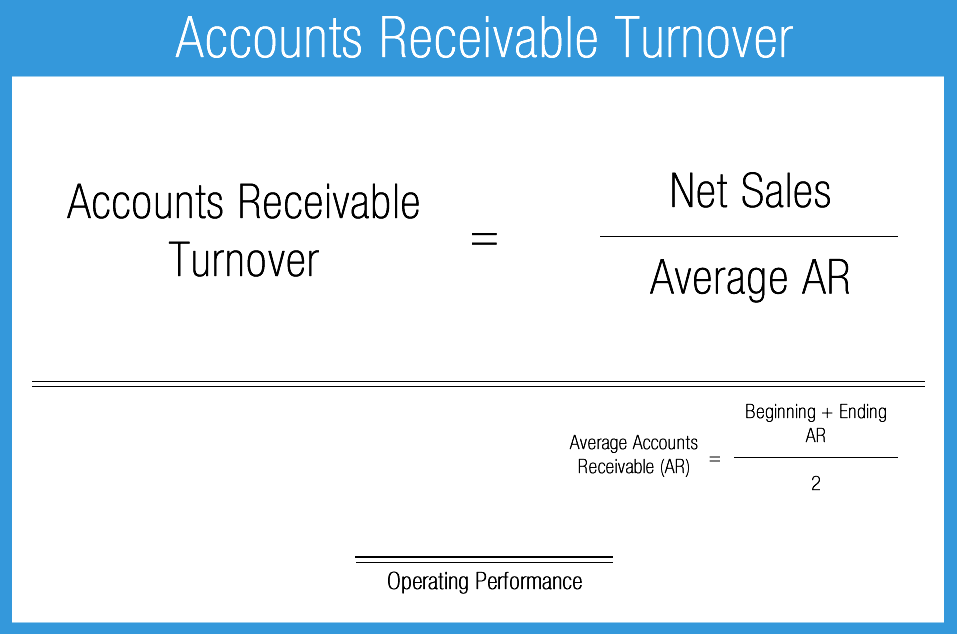

Represents the company’s profit divided by the outstanding shares of its common stock. March Infinera Corp (INFN.O), a U.S. manufacturer of semiconductors for the telecommunications industry that competes with China’s Huawei, is exploring options that include a sale of the company, according to a person familiar with the matter. As an FPGA verification engineer at Infinera, you will work with high-complexity DWDM equipment for long-haul/ultra-long-haul applications.