Data Consolidation in Excel simplifies handling multiple data sources, creating organized summaries that ease analysis, reduce errors, & support better insights. ChartExpo enhances the CVP chart by incorporating dynamic features like real-time data updates. This, as a result, facilitates adaptability to changing market conditions.

Graphical Representation of Break-even Analysis FAQs

In summary, the sales price is an important component of Cost-Volume-Profit (CVP) analysis. By understanding the impact of changes in sales price on contribution margin, break-even point, and profitability, businesses can make informed decisions about pricing that maximize profits. In this example, identifying fixed costs is essential for understanding the store’s profitability and cash flow.

Submit Your Info Below and Someone Will Get Back to You Shortly.

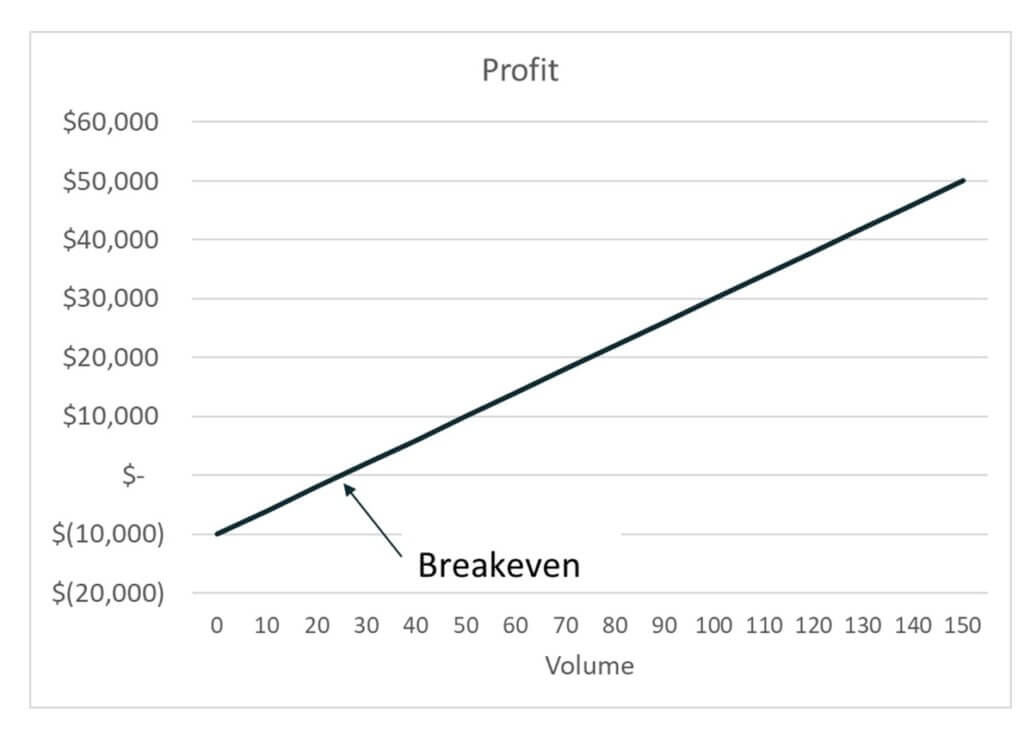

An advantage of the P/V graph is that profit and losses at any point can be read directly from the vertical axis. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. However, very few managers know about the profit structure in their own company or the basic elements that determine the profit structure. For many people, the easiest way to visualise this figure is by creating a cost-volume-profit graph. Ultimately, CVP analysis provides a clear picture of a business’s financial situation and allows for strategic planning to achieve long-term success. Finally, remember that the method assumes that all units made are going to be sold.

Ask Any Financial Question

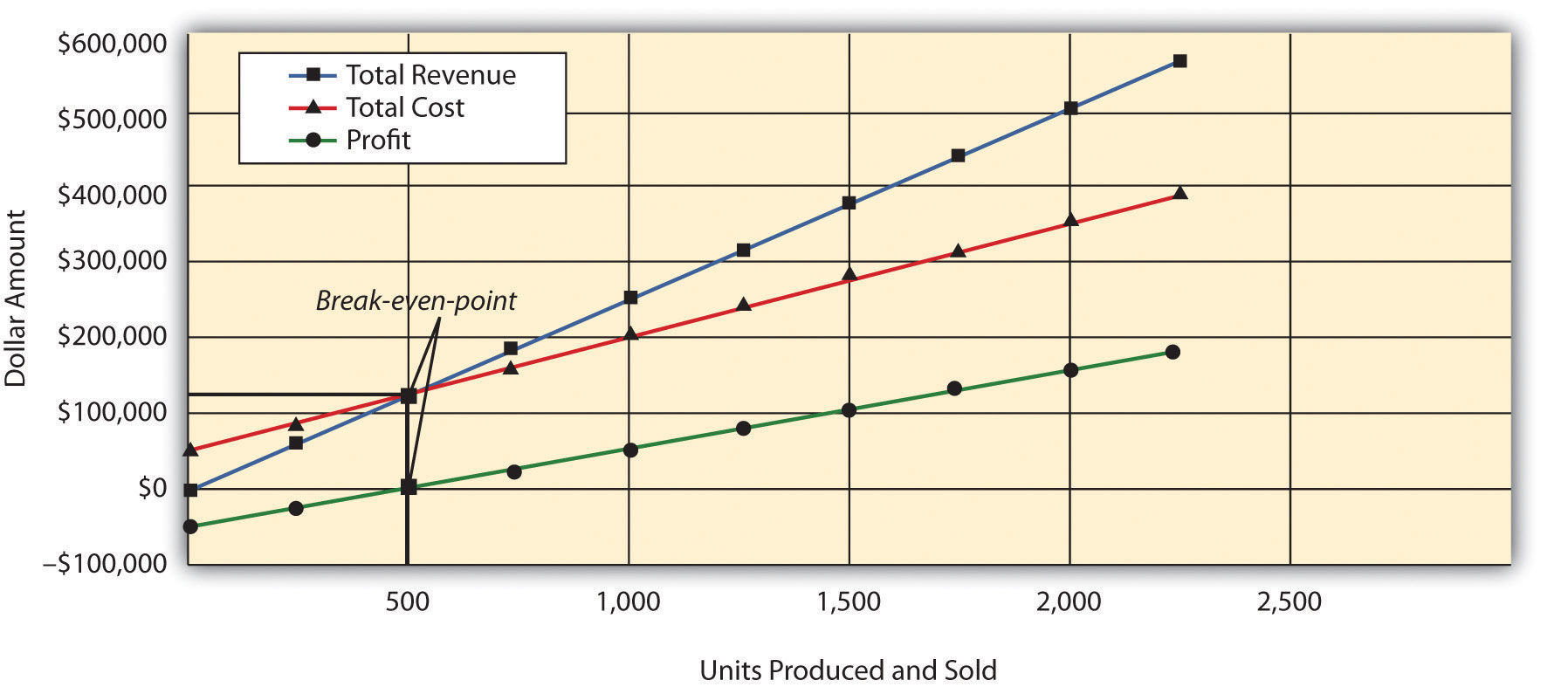

Second, fixed costs can significantly impact a company’s profitability and cash flow. The contribution margin per unit is calculated by subtracting the variable cost per unit from the selling price per unit. It illustrates the sum of fixed and variable costs corresponding to different sales volume levels. This line may vary in slope chart and shape based on the business’s cost structure. Cost-volume-profit (CVP) analysis is a method that helps managers understand how changes in costs and sales volume affect a company’s profit. This analysis is crucial for decision-making in areas such as pricing, production levels, and product line management.

This means that for every widget sold, the company contributes $5 towards covering the fixed costs and generating a profit. In this example, the total contribution margin for the company is $15,000 for 3,000 units sold. Looking at CVP this way we get a more comprehensive view of required sales volumes to get a 45,000 euros pre-tax income. This income statement shows us that to get the targeted income; we have to achieve the respective sales and keep variable and fixed costs at the specified levels.

Graphical Representation of Break-even Analysis

A CVP analysis is used to determine the sales volume required to achieve a specified profit level. Therefore, the analysis reveals the break-even point where the sales volume yields a net operating income of zero and the sales cutoff amount that generates the first dollar of profit. Semi-variable or semi-fixed costs are particularly tricky to break down, as the proportion of fixed and variable costs can also change.

Basically, it shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. So, for a business to be profitable, the contribution price earnings pe ratio formula calculator 2023 margin must exceed total fixed costs. The contribution margin is the difference between total sales and total variable costs. For a business to be profitable, the contribution margin must exceed total fixed costs.

- As it focuses mainly on the Break-even point, it is commonly referred to as Break-even Analysis.

- At one point, the company’s founder was so busy producing small pizzas he did not have time to determine that the company was losing money on them.

- The variable cost per DVD is$12, and the fixed costs per month are $ 40,000.

The main components of CVP Analysis are cost structure, sales volume, and revenue. Each component is studied about one another to determine how changes in any one area will affect overall profitability. CVP analysis provides valuable insights into a company’s financial performance and helps managers make informed decisions that maximize profits. We can also calculate the CVP equation to get the required sales volume to realize the desired target profit (targeted income). Segregation of total costs into its fixed and variable components is always a daunting task to do.