Gross profit is what’s left of your revenue after deducting the cost of goods sold (COGS)—the direct costs related to producing goods or providing services. After discounting for any nonrecurring events, it’s possible to arrive at the value of net income applicable to common shares. Microsoft had a much higher net income of $61.27 billion compared with Walmart’s $13.67 billion.

- These take minimal time to prepare and don’t differentiate operating versus non-operating costs.

- We’ve broken down the steps for preparing an income statement, as well as some helpful tips.

- After discounting for any nonrecurring events, it’s possible to arrive at the value of net income applicable to common shares.

- If a company purchases inventory, the balance sheet will reflect the change in inventory value while the income statement recognises the change in COGS, affecting the net income.

- This section starts with the net income from the income statement and adjusts it for non-cash items such as depreciation and changes in working capital, including accounts receivable, accounts payable, and inventory.

- Income statements are an essential financial document for investors and business owners, providing valuable insights into a company’s financial performance over a specified period, usually a quarter or a year.

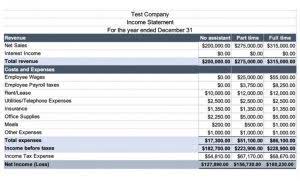

Typically, multi-step income statements are used by larger businesses with more complex finances. However, multi-step income statements can benefit small businesses that have a variety of revenue streams. Single-step income statements are the simplest and most commonly used by small businesses.

What are the key components of an income statement?

The income statement can also help you make decisions about your spending and overall management of business operations. Income statements should be generated quarterly and annually to provide visibility throughout the year. Gross profit is the difference between the total revenue and the cost of goods sold (COGS). This margin represents the percentage of revenue that a company retains after considering the cost of producing its goods or services. These are all expenses incurred for earning the average operating revenue linked to the primary activity of the business.

A balance report provides all of the end balances required to create your income statement. Net income—or loss—is what is left over after all revenues and expenses have been accounted for. If there is a positive sum (revenue was greater than expenses), it’s referred to as net income. If there’s a negative sum (expenses were greater than revenue during that period), then it’s referred to as net loss.

Operating Income vs. Net Income

Payment is usually accounted for in the period when sales are made, or services are delivered. Income statements can be prepared monthly, quarterly, or annually, depending on your reporting needs. Larger businesses typically run quarterly reporting, while small businesses may benefit from monthly reporting to better track business trends. Losses include money lost through activities outside of transactions for your primary goods or services.

Income statements are an essential financial document for investors and business owners, providing valuable insights into a company’s financial performance over a specified period, usually a quarter or a year. These statements summarize the financial transactions, including revenues, expenses, and net income, allowing you to assess a company’s profitability and overall financial health. By understanding how to read an income statement, you’ll be equipped with the knowledge to make informed decisions about investments and business operations.

Comparing Income Statement to Other Financial Statements

However, real-world companies often operate on a global scale, have diversified business segments offering a mix of products and services, and frequently get involved in mergers, acquisitions, and strategic partnerships. Income statement reports show financial performance based on revenues, expenses, and net income. By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance. Net income or net profit, on the other hand, is the bottom line of the income statement that considers all revenues and expenses, including financial, operating, and tax expenses. It is essential to understand the difference between operating income and net income to assess how effectively the company is managing its resources and whether it can generate sustainable profitability. By understanding the income and expense components of the statement, an investor can appreciate what makes a company profitable.

In summary, understanding the structure of an income statement is vital for evaluating a company’s financial performance. Familiarize yourself with the components, and pay attention to the format used, whether it’s a single-step or multi-step income statement, to make informed decisions about the company’s profitability and financial health. The income statement, also known as the profit and loss (P&L) statement, is the financial statement that depicts the revenues, the focus of an income statement is on expenses and net income generated by an organization over a specific period of time. It is one of the most heavily scrutinized financial statements issued by every organization. Because of this, it is critical for users to have a sound understanding of the story every income statement is trying to tell. An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period.

Understanding the Income Statement Structure

If you have more than a few income streams or a complicated financial landscape, you might use multi-step income statements to get a better view of your profits and losses. To gauge a company’s profitability, one can look at the net income figure on the income statement. If the net income is positive, it indicates that the company is earning more than it spends and is profitable. A negative net income shows that the company is spending more than it earns, resulting in a loss.

Comparing net sales across different financial periods reveals insights into the company’s sales performance, efficiency, and customer satisfaction levels. A continuous increase in returns, for instance, may indicate a product quality issue, while a larger volume of discounts may signal the need for a pricing strategy revision. Microsoft had a lower cost for generating equivalent revenue, higher net income from continuing operations, and higher net income applicable to common shares compared with Walmart. To understand the above formula with some real numbers, let’s assume that a fictitious sports merchandise business, which additionally provides training, is reporting its income statement for a recent hypothetical quarter.